The loophole which allows holiday home owners to avoid council tax and business rates was raised in Parliament this week by Member of Parliament for North Cornwall, Scott Mann.

According to reports by Cornwall Live earlier this year, there are 20,000 holiday lets in Cornwall, with nearly 8,000 registered as businesses. This exempts them from council tax and potentially makes them eligible for Small Business Rate Relief (SBRR), which allows up to 100 per cent relief depending upon the rateable value of the property. If a holiday let qualifies for full SBRR, then the owner will not pay any business rates as well as zero council tax.

A property is considered a holiday let if it is available for let for at least 140 days per year.

On Tuesday, Scott Mann raised the issue with ministers during proceedings of a government bill which will allow councils to charge double council tax for properties that have been empty for two years. The move is expected to encourage empty home owners to bring them back into use.

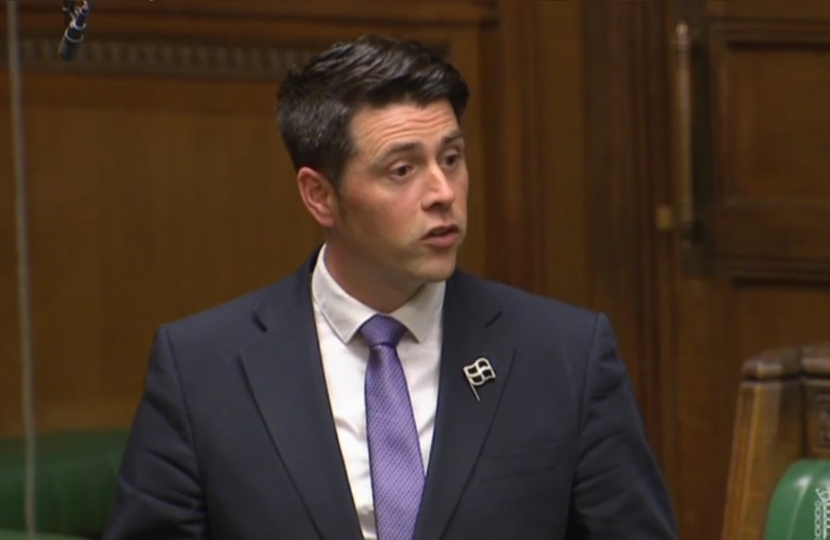

Speaking in the House of Commons, Scott Mann raised the loophole with Local Government Minister Rishi Sunak MP.

Mr Mann said:

“I have spoken to the Minister about this several times, and I know he understands the challenges we face in Cornwall with second home ownership and vacant properties. How will the Bill differentiate a second home and a vacant home?”

In response, the minister confirmed that he was investigating the loophole that allows holiday home owners to avoid council tax and business rates.

Minister Sunak said:

“My hon. Friend has raised second home ownership in his rural constituency many times with me and other colleagues, and he is right to do so. Rural areas face challenges with second home ownership - coming from a rural constituency myself, I fully sympathise with some of his points.

“Current legislation makes a distinction between second homes and empty homes. We are considering long-term empty homes, which are defined as homes which are “substantially unfurnished” and have been unoccupied for two years. Second homes are covered by a different part of council tax legislation, and the Government previously removed the necessity for local authorities to charge a discount on council tax. They are now allowed to charge the full amount.

“My hon. Friend will be aware that the Department is considering the treatment of second homes and business rates - he and other colleagues have asked me whether it is appropriate for some second home owners registered for business rates to benefit from small business rate relief and therefore pay no taxes, and whether our legislation captures fair use of that provision correctly. I am currently investigating that.”